Six Ways Oil and Gas Companies Are Addressing Sustainability and What It Means for Automation

Oil and gas giants are embracing sustainability by investing in renewable energy, reducing emissions, and enhancing safety measures. This transformative shift is driving advancements in automation and operational technologies, paving the way for a more sustainable energy future.

![[object Object]](https://admin.industrialautomationindia.in/storage/articles/article-TIuBrRGTRLaKVUAcAX4ZpyHAbZlBJhtDtSXTTAw9.jpg)

For major oil and gas end users, this means investment in new technologies that may be outside the traditional scope of upstream and downstream operations, says Larry O’Brien.

Major oil and gas companies are taking significant steps to reduce emissions, improve worker and process safety, and provide more renewable sources of energy. This will drive growth in many key segments of the automation marketplace.

When most people think of sustainability they probably think of things like electric vehicles, renewable power, and recycling, but the world’s largest hydrocarbon producers – the integrated oil and gas companies – are taking significant steps toward net zero emissions and carbon neutrality. Even as the world continues its transition to renewable energy, demand for hydrocarbons, in the form of oil and natural gas, continues to increase and will remain the foundation of the global energy mix for the foreseeable future. After a brief dip in demand due to Covid in 2019, oil demand is increasing. The war in Ukraine has restricted energy supply and flow worldwide and a new economic blueprint for the oil industry is forming as regions that previously depended upon Russian oil and gas have scrambled to find new sources of supply. According to the latest release of the BP Statistical Review of World Energy, fossil fuels still represented 82 percent of worldwide primary energy use in 2022.

It makes a lot of business sense for oil companies to adopt sustainability strategies. Adopting a sustainability strategy can eliminate a significant amount of waste in the form of reduced emissions, eliminating oil spills and pipeline leaks, and capturing countless metric tonnes of methane and other substances that are released into the atmosphere. But the oil companies are not focused on existing oil and gas related processes alone. The large integrated oil and gas companies are transforming themselves into energy companies, making huge investments in sustainable power, in the form of wind, solar, and hydrogen, and are entering into long-term energy contracts with large end users like Amazon to provide renewable energy at scale.

Let’s take a look at six ways oil and gas companies are moving forward with sustainability, which includes net zero emissions, flaring reduction, net carbon energy intensity reduction, worker and process safety, reducing spills, and investment in low carbon electricity and renewables. Each of these areas has a significant impact on automation and OT technology investments, from the sensor level to basic control, MES applications, cybersecurity, and more.

Net zero emissions

Oil companies have established concrete emission reduction goals. Shell's target, for example, is to become a net-zero emission company by 2050. In 2021, the company took an important step towards becoming a net-zero emissions business with a new target to reduce absolute emissions from operations (Scope 1 and Scope 2) by 50 percent by 2030, compared with 2016 levels. ExxonMobilplans to invest approximately $17 billion through 2027 on lower greenhouse gas emission initiatives.

Flaring reduction

When it comes to net zero emissions, oil companies are looking at more than just emissions reduction itself. Flaring, where product, either gas or liquids, is burned because it cannot be captured. According to the World Bank, the amount of product flared in a year is 140 million cubic metres, is enough to power all of sub-Saharan Africa. Flaring accounts for seven percent of overall greenhouse gas emissions. It is the World Bank guidelines on flaring, also known as the Zero Routine Flaring by 2030 initiative that many of the major oil companies have agreed to honour. ExxonMobil, for example, recently announced that it will eliminate routine flaring globally by 2030. Expect increased investment in flare gas recovery systems, and vapour recovery systems. All these systems have associated automation, sensor, and actuator components as well as more advanced forms of software.

Shell 2021 Sustainability Report.

Net carbon energy intensity reduction

Major oil and gas companies are focused on reducing the amount of energy and carbon required to produce a unit of product, also known as net carbon energy intensity reduction. Vast energy efficiency programs are being implemented to reduce this carbon intensity, from electrification of offshore operations to the adoption of carbon intensity metrics. Chevron, for example, has adopted a Portfolio Carbon Intensity Metric (PCI), which represents the company's carbon intensity across its entire value chain, including Scope 3 emissions associated with bringing its products to market. Developing carbon intensity metrics can create more efficient processes; identify opportunities for decarbonisation, and more. Aramco too is working to reduce net carbon intensity, and is working on solutions like advanced carbon capture and storage and circular carbon economy technologies.

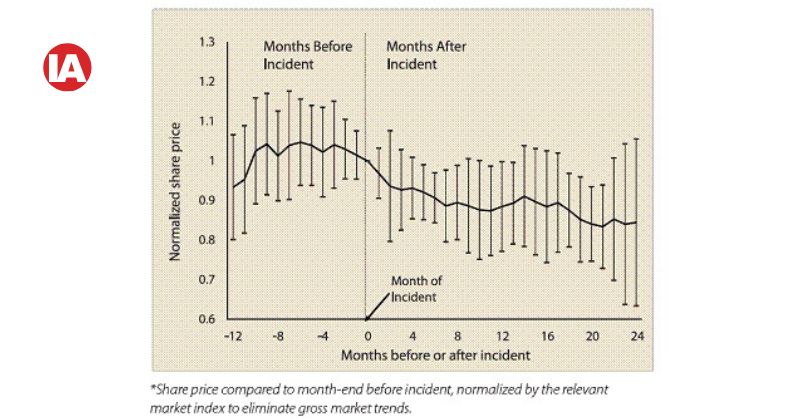

Worker and process safety

Improving worker and process safety is a core component of any oil and gas company's sustainability strategy. Worker and process safety encompasses reducing safety incidents, reducing spills and uncontrolled release of products, and improving both physical safety and cybersecurity. Incident reduction includes both the safety of workers and reducing unplanned incidents and downtime. Worker safety is paramount. All major oil and gas companies have initiatives to drive incidents and employee accidents and fatalities to zero, as well as mature process safety organisations and lifecycle processes. Unplanned downtime is the bane of the oil and gas industry, and the financial impact of unplanned downtime on industry as a whole is over a trillion dollars a year.

Investment in process safety systems and safety instrumented systems (SIS), continues to grow. In the wake of the Triton malware attack on process safety systems in the Middle East several years ago, oil and gas end users have taken more stringent steps to secure process safety and process control systems in both the upstream and downstream sectors. End users are adopting risk-based approaches to cybersecurity just as they have with process safety to quantify and better address risk and reduce likelihood of cyber incidents that could affect key processes. A Cyber HAZOP/Cyber PHA discipline has emerged to evaluate cyber risk and criticality in highly volatile downstream processes. Safety, cybersecurity, and sustainability are closely intertwined, and many end users include information on their cybersecurity activities as part of their sustainability reports.

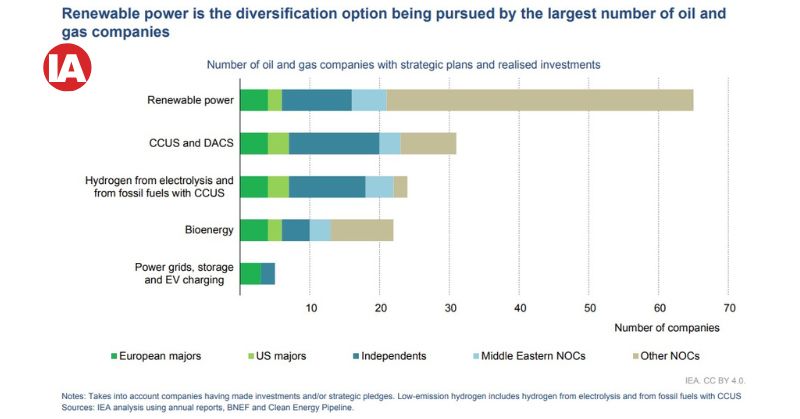

in renewables (Source: IEA World Energy Investment 2023).

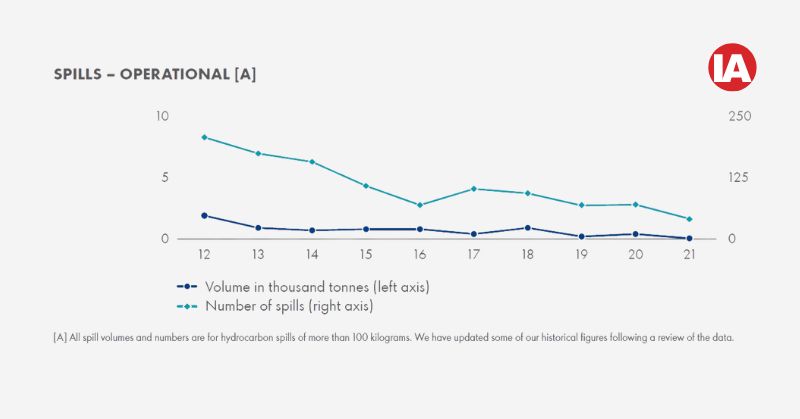

Reducing spills

Oil and other product spills are responsible for a tremendous amount of environmental damage, and they can severely damage an oil company's reputation. Many major oil companies are taking steps to reduce spills to zero. While it's hard to prevent spills and pipeline leaks in the event of deliberate sabotage, as we saw with the NordStream pipeline incident, there are many other measures that are being taken. Shell, for example, in 2021, reduced the number of operational spills of more than 100 kilograms by 40 percent compared with 2020. Many spills are due to equipment failures, so more proactive efforts are needed in the areas of predictive maintenance, sensing technology, and asset management solutions to prevent major equipment failures that lead to spills and leaks. Many end users are now employing AI-based leak detection solutions so they can identify leaks sooner.

Investment in low carbon electricity and renewables

Many of the large oil companies realize that the long-term future is not just hydrocarbons, but all sources of energy. This includes renewable energy sources, primarily consisting of wind, solar, and hydrogen. Also included are things like mobility, green logistics, and energy solution contracts. BP has an agreement with Amazon to provide renewable energy to Amazon's operations. Lighthouse bp, in which BP has a 50 percent investment, executed a power purchase agreement with Amazon in 2021 for a 375 MW solar project in Ohio.

Hydrogen is another key area of investment for all oil majors. Aramco, for example, is developing its blue ammonia and hydrogen business, with the goal of producing up to 11 million metric tons of blue ammonia per year by 2030. This initiative is designed to support significant emissions reductions in sectors that have traditionally been hard to decarbonize, such as heavy-duty transport, heating and industrial applications.

Recommendations

Any investment in new processes and technologies will have a positive impact on the automation market. Increased sustainability efforts will create significant new investment in a broad range of technologies from the sensor to enterprise level. Wind farms, for example, are increasingly investing in industrial edge computing platforms. Flaring reduction efforts and overall emissions reduction efforts are leading to increased investment in things like flaring control systems, pipeline corrosion monitoring solutions, and continuous emissions monitoring systems.

For major oil and gas end users, this means investment in new technologies that may be outside the traditional scope of upstream and downstream operations. Increased care must be taken in supplier and technology selection. For automation suppliers, the transition to these new sustainability efforts will require more knowledge of these new processes and technologies and the associated challenges. Suppliers will have to keep pace helping end users solve these emerging challenges.

Larry O'Brien is Vice President, Research, ARC Advisory Group. Larry joined ARC in 1993 and has an extensive background covering control systems, networks, sensors, and software for the industrial and critical infrastructure segments. In addition to over 30 years of market research experience, Larry has participated in many custom consulting engagements with end user and owner/operator clients in these industries, ranging from large scale supplier selection projects to controls strategy development, technology evaluation, custom surveys, and benchmarking.

For the past three years, Larry has been part of both the cybersecurity and smart city practices at ARC and has authored a number of research papers, market reports, and articles on ICS/SCADA cybersecurity and smart city technologies, applications, and best practices. Larry has also made numerous public speaking appearances as both a presenter and MC/moderator for these topics at events such as the ARC Industry Forum, ABB Customer World, Honeywell User Group Meeting, ICSJWG, and ICS Cybersecurity conferences.

ARC Insights are published and copyrighted by ARC Advisory Group. The information is proprietary to ARC, and no part may be reproduced without prior permission from ARC. For further information or to provide feedback on this Insight, please contact your account manager or the author at [email protected].

_____________________________________________________________________________________________

For a deeper dive into the dynamic world of Industrial Automation and Robotic Process Automation (RPA), explore our comprehensive collection of articles and news covering cutting-edge technologies, robotics, PLC programming, SCADA systems, and the latest advancements in the Industrial Automation realm. Uncover valuable insights and stay abreast of industry trends by delving into the rest of our articles on Industrial Automation and RPA at www.industrialautomationindia.in